Unit margin formula

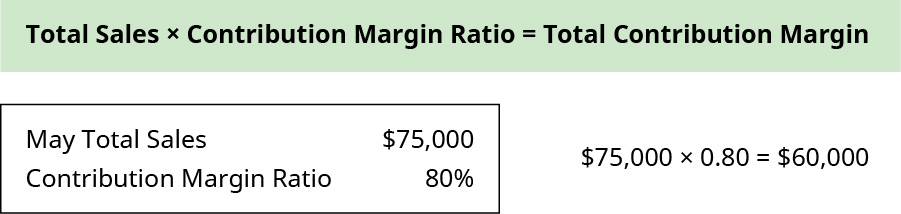

All you have to do is multiply both the selling price per unit and the variable costs per unit by the number of units. Calculating the variable margin can help you determine the break-even pointthe point at which a company covers its fixed expenses and doesnt earn a profit.

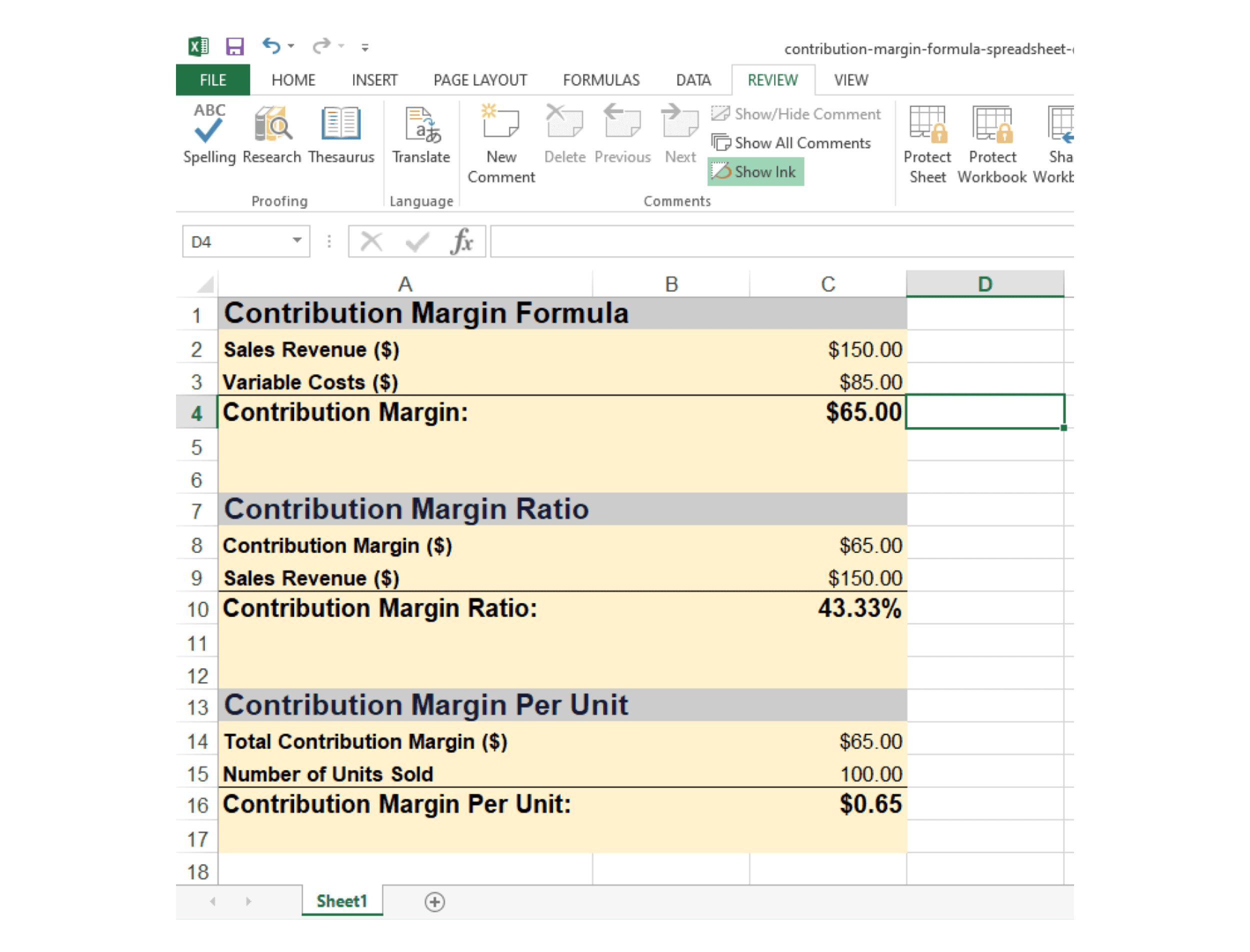

Contribution Margin Formula And Ratio Calculator Excel Template

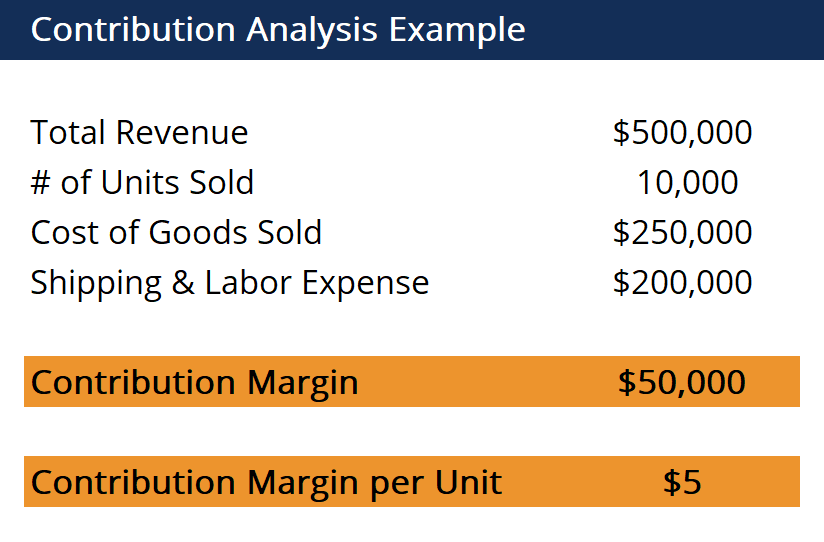

Heres how it works for Company ABC.

. The contribution margin formula is quite straightforward. The formula for Gross Margin can be calculated by using the following steps. Gross margin is a companys total sales revenue minus its cost of goods sold COGS divided by total sales revenue expressed as a percentage.

To calculate Net Profit Margin we need net income and net revenue and we need to compute the same. Net Profit Margin Net Income Revenue x 100. As you can see in the above example the difference between gross vs net is quite large.

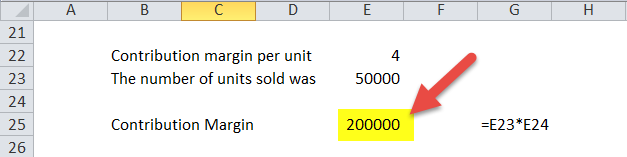

The number of units sold was 50000 units. Divide this number by your revenue to express your profit margin as a percentage of revenue. Net profit is calculated by deducting all company expenses from its total revenue.

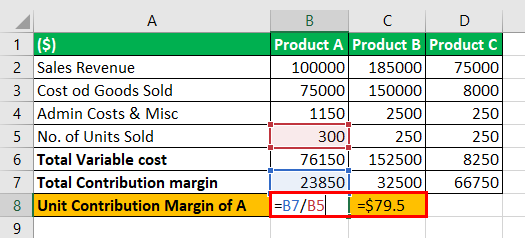

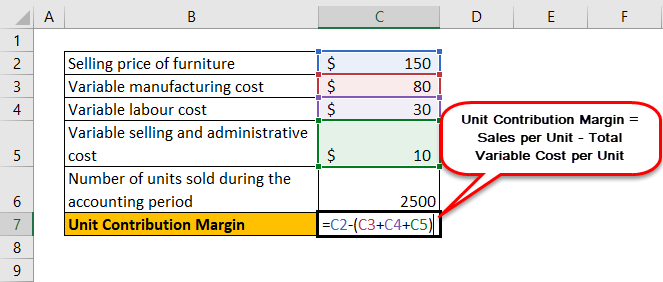

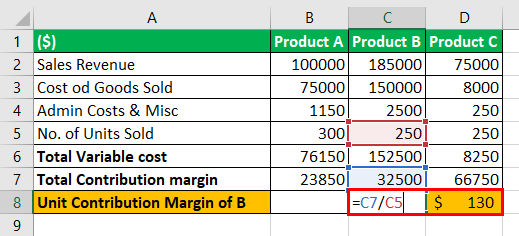

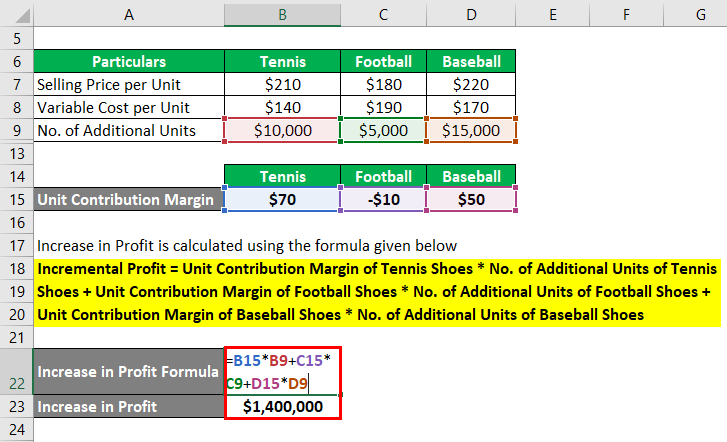

Net revenue or sale figure is given which is 5000000 and from this figure we will. Contribution margin per unit formula would be Selling price per unit Variable cost per. In this case the contribution per unit formula will be as follows.

What is Average Unit Margin AUM. Net Profit margin Net Profit Total revenue x 100. To do this divide.

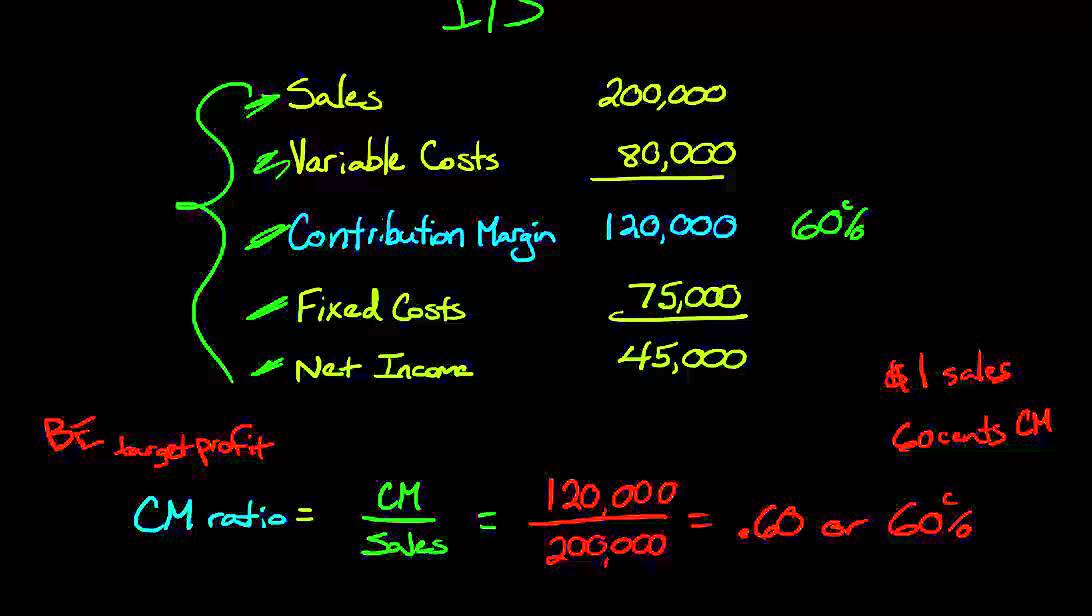

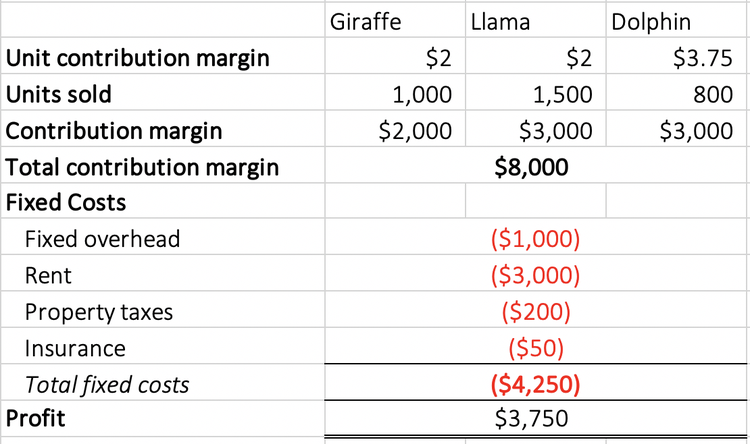

Net Profit Margin Formula. Contribution per unit Contribution margin Total units. Contribution margin per unit formula would be Selling price per unit Variable cost per unit Variable Cost.

The result of the. Heres how it works for Company ABC. In 2018 the gross margin is 62.

Average Unit Margin is a merchandising KPI that measures the average margin of a particular product. The above formula for contribution per unit assumes. In other words contribution margin per unit is the amount of money that each unit of your product generates to pay for the fixed cost.

This ratio represents the percentage of sales. Accordingly the contribution margin per unit formula is. Firstly figure out the net sales which are usually the first line item in the income statement of a company.

Total costs number of units cost per unit. Heres Sean Corson Daasitys Chief. We can represent contribution margin in percentage as well.

Start with a goal unit contribution margin calculate your variable costs and back into your selling price from there. Alternatively it is known as the contribution to sales ratio or Profit Volume ratio. Selling price goal unit contribution.

In 2018 the gross margin is 62. The variable cost per unit is 2 per unit.

Contribution Margin What It Is And How To Calculate It

Contribution Margin Formula And Ratio Calculator Excel Template

Contribution Margin Meaning Formula How To Calculate

Unit Contribution Margin Meaning Formula How To Calculate

Contribution Margin Ratio Youtube

Unit Contribution Margin Meaning Formula How To Calculate

7 1 Exploring Contribution Margin Financial And Managerial Accounting

Contribution Margin Ratio Formula Per Unit Example Calculation

3 1 Explain Contribution Margin And Calculate Contribution Margin Per Unit Contribution Margin Ratio And Total Contribution Margin Business Libretexts

Contribution Margin Ratio Revenue After Variable Costs

Weighted Average Unit Contribution Margin Double Entry Bookkeeping

Unit Contribution Margin Meaning Formula How To Calculate

Unit Contribution Margin How To Calculate Unit Contribution Margin

Unit Contribution Margin Meaning Formula How To Calculate

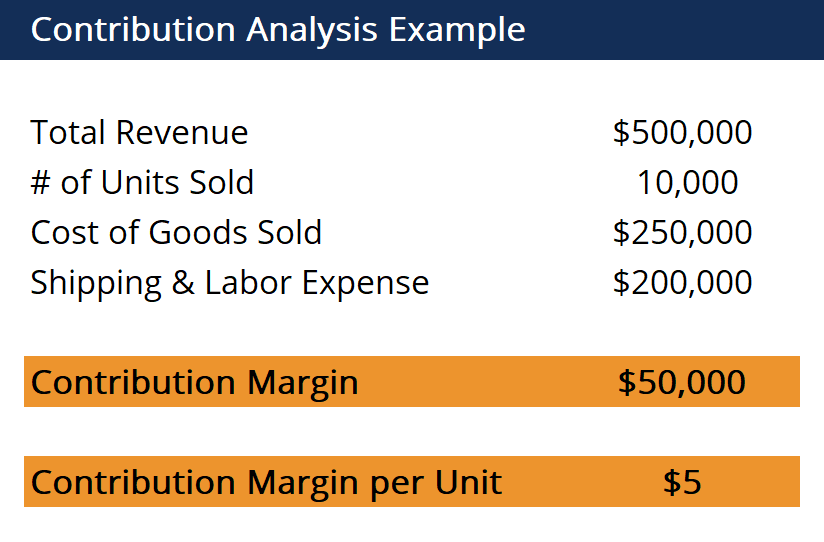

Contribution Analysis Formula Example How To Calculate

Contribution Margin Formula And Ratio Calculator Excel Template

How To Calculate The Unit Contribution Margin